While not a mind-blowing move, it is good to see that the Dana Incorporated (NYSE:DAN) share price has gained 13% in the last three months. But that doesn’t change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 19% in that half decade.

See our latest analysis for Dana

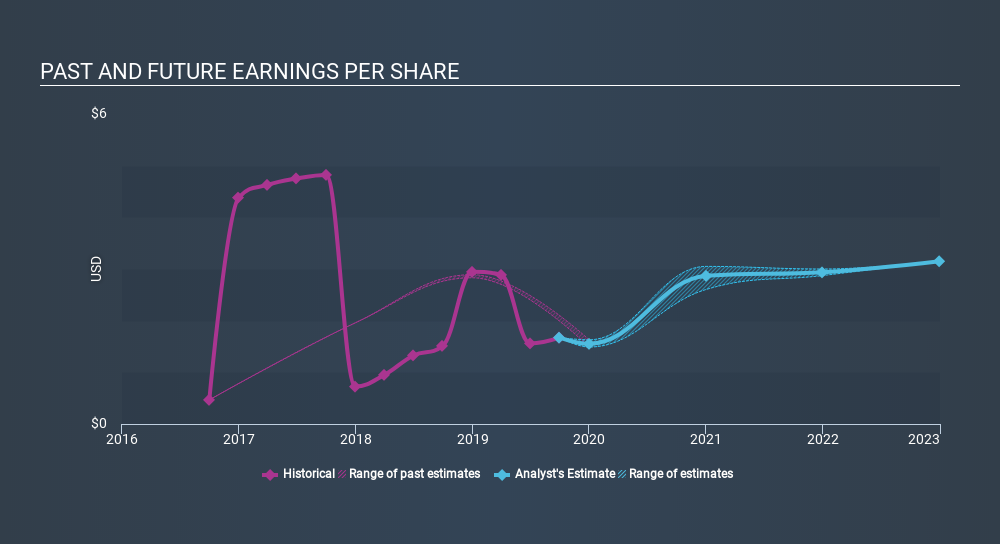

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

While the share price declined over five years, Dana actually managed to increase EPS by an average of 0.7% per year. So it doesn’t seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Given EPS is up and the share price is down, it’s clear the market is more concerned about the business than it was previously. Generally speaking, though, if the company can keep growing EPS then the share price will eventually follow.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Dana has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Dana’s TSR for the last 5 years was -12%, which exceeds the share price return mentioned earlier. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Dana shareholders are up 6.3% for the year (even including dividends) . Unfortunately this falls short of the market return. On the bright side, that’s still a gain, and it is certainly better than the yearly loss of about 2.6% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we’ve discovered 3 warning signs for Dana which any shareholder or potential investor should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Discounted cash flow calculation for every stock

Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market, so if you want to find the intrinsic value of any company just search here. It’s FREE."Dana" - Google News

January 11, 2020 at 08:34PM

https://ift.tt/35LoItI

Did Changing Sentiment Drive Dana’s (NYSE:DAN) Share Price Down By 19%? - Simply Wall St

"Dana" - Google News

https://ift.tt/2ObKhgs

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Did Changing Sentiment Drive Dana’s (NYSE:DAN) Share Price Down By 19%? - Simply Wall St"

Post a Comment